The perception of the deathcare industry from outside is one of tradition, family-run services and perhaps a little mystery. Few would categorise it as a rapidly changing and dynamic environment and yet a deeper look is all it takes to reveal several clear trends driving deathcare towards a radically different future. The word deathcare is itself a relatively new term. Its first known use was in 1987 but it is only more recently that it became better understood and more widely used.

Cultural shifts in society bring change

Part of the reason for the emergence of this new vocabulary is down to a wider cultural shift in society which has been reflected in the funeral sector. Mental health, while not new per se, has never received as much attention or assumed the level of importance as it does today. In the funeral arrangement business this has translated to the rising importance of aftercare. The client relationship no longer stops after the ceremony or final payment. Funeral directors are increasingly considering how best to thank their clients, what an appropriate communication on the anniversary of a loved one’s passing looks like and to what extent the funeral home is responsible for facilitating grief management services.

Macro-economic events such as the banking crisis and the ongoing COVID-19 pandemic have brought with them austerity, uncertainty and for many a sharper sense of the need to plan personal finances. This, combined with rising funeral costs, has made pre-planning an undeniable trend in deathcare. Not only can it save potential costs and spread outlay across a number of years, it is in itself another manifestation of how the mental health of the bereaved is now taken into account even before the death has occurred. Those planning ahead are often doing so to prevent future distress for relatives and what they already know will be an emotionally difficult moment. In short, pre-planning belongs to the financial planning trend as well as the movement towards greater mental health awareness.

In some cultures, professional mourners were traditionally used to increase attendance at funerals or dramatise ceremonies. Even in the UK, such services such as the now defunct Rentamourner website, persisted into modernity. However, as the current status of the company suggests, they were swimming against the tide. Rather than increased mourning, the clear cultural shift now is marked by the move toward celebrating a life lived rather than displaying sadness at the loved one’s sudden absence. Different families or groups of friends might have incompatible preferences for celebratory events which in some cases might mean multiple concurrent or even digital events. More celebration has led to more personalisation as clients seek to match events with the personality, lifestyle and wishes of both the deceased and their social circle. Quite the task for a funeral arranger to manage and many consider that their primary role is now trending closer to being an event planner for memorial services.

Changing customer preferences

As we have already mentioned, the idea of a “standard” funeral has been quickly evaporating or at the very least the notion has become ambiguous. For some, a Church based religious ceremony with a traditional ceremony remains a must. However, with the 2021 census expected to reveal fewer than 50% of the population identifying as Christian funeral directors should expect to serve not only a more religiously diverse clientele but also a significant and growing number of atheists. This will impact expectations and preferences around several facets of a modern funeral from eulogies to gravestones and beyond. If you are interested in devling deeper we have a full article dedicated to atheist funeral arranging.

Leaving the question of faith aside there are numerous other observations which suggest customer preferences are evolving. What might once have been regarded as quirky requests are now becoming commonplace. For example, funeral directors are now frequently requested to make arrangements for the presence of pets at funerals. Meanwhile floral tributes have become more eclectic with many wanting a personalised arrangement or even specific elements such as a football team badge to be incorporated. According to a study by British Seniors 28% of funeral attendees are no longer wearing black and 18% are not singing hymns. They also found a growing interest in releasing balloons, butterflies or doves, an event now occurring at 8% of UK ceremonies.

Despite this diversification in preferences, some broad trends still emerge with the obvious one being the steady rise of cremations. Although the ONS does not track cremations we know from Cremations.org.uk that they have risen from being a negligible percentage of all deaths a century ago to being the clear majority now with over three quarters of deaths being cremated deaths. Some of this is owed to the increasing interest in a low cost no-frills approach with many people now expressing a wish to depart without a fuss. And, in addition to saving burial costs, electing cremation means that ashes can be used for a variety of memorial purposes such as urns, keepsakes or repurposed as meaningful jewelry.

Another clear trend in customer preferences is the demand for greater transparency. This is again part of a wider societal trend across service industries in general. Partly brought on by the greater access to information of the internet era and partly by the mass media presence of national advertisers from the funeral sector, the general public has become more aware of the choice available to them. Consequently they prefer a clear presentation of prices and the ability to compare across service providers. The CMA’s report of December 2020 identifies pricing as a concern and introduced solutions which include requirements on funeral directors to publish prices to customers as well as a prohibition on solicitation.

Digitisation of deathcare

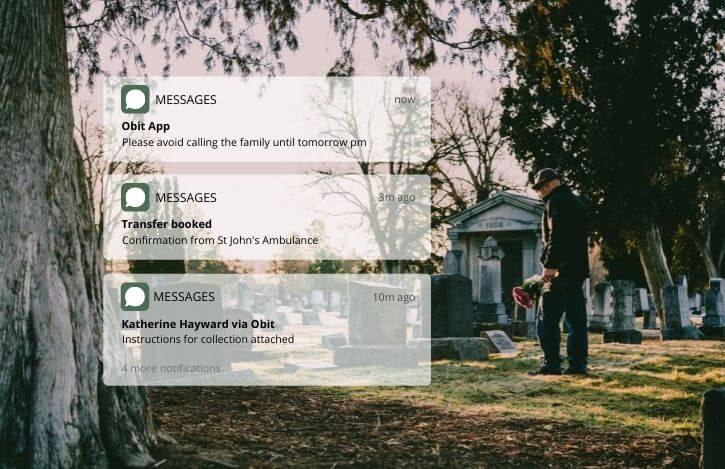

Very few areas of life have been left untouched by the technological revolution we are living in and deathcare certainly isn’t one of them. When it was first invented few would have envisaged live-streaming, for example, being applicable to funerals but today’s funeral professionals require a certain level of tech sophistication both to understand customer’s digital needs as well as to deliver them. While digitisation is a clearly identifiable trend and most funeral directors already rely on numerous apps, this does not mean the technological evolution is over.

Mark Lynch, co-founder of the funeral management app Obit, says that “funeral tech is just getting started.” He envisages tech-enabled operations to be the norm for most funeral directors within a decade. Tributes, notices and funeral invoicing, will be done digitally by default and Obit already offers much of this through its existing software which is designed specifically for the needs of the deathcare industry. Even complex multi-branch funeral operations are able to run smoothly through a single app seamlessly integrating branches, accounting partners and suppliers. The savings on admin are clear and Mark envisages that the time saved by funeral professionals will be reinvested in creating the kind of unique and personalised memorial services increasingly being requested.

Elsewhere technology is having an impact in even less expected ways. The number of unidentified persons, for example, is being reduced by applying facial recognition to corpses. AI Systems originally designed to recognise living human beings are being used by police forces and governments as a complement to DNA analysis in order to better identify corpses and reduce the number of burials of unknown persons. These advances, though not without their complications, should help to accelerate identifications and increase the number of meaningful memorial events.

Increased regulation & professionalisation

Standards and rules around deathcare vary greatly from country to country and are implemented in a variety of ways. In the UK we can broadly identify a trend towards greater regulation with the CMA having opened up a market investigation into the supply of services by funeral directors in 2018 and the FCA’s upcoming regulation putting prepaid plans under their control and away from the Funeral Planning Authority. Although studies have shown that the general public was largely unaware that Funeral Directors were unregulated, part of this regulatory trend is still driven by consumer demand for greater transparency on issues such as pricing, competition and rights.

In parallel to governmental regulation there is a decentralised movement towards a more business centric approach to operations. Although it may not feel that way to the average family-run funeral home, deathcare is now worth an estimated £1billion annually, with over 600,000 funerals taking place each year. No surprise then that larger corporations have sought to move into the sector either by acquiring funeral businesses and transforming them into chains or by providing auxiliary services.

There are even several notable venture capital funded participants. Startups such as Everdays, which specialises in selling pre-planned packages, and UK-based Farewill, which accounts for 1 in 10 of the country’s wills, have received funding running into the millions or even tens of millions. They are part of the new wave of tech-enabled professionalisation in what was once a sector managed almost exclusively by hyper-local family-based setups. The future of the funeral industry is not easy to predict but what is certain is that it won't remain static. The sector is undergoing multi-directional change which looks set to continue and even accelerate in the years to come.

Comments powered by Talkyard.